My year with Chase UK's current & savings accounts

Chase is a relatively new addition to the UK banking market, and is owned by JP Morgan. They offer an app-only current account with cashback and a linked savings account, and in under a week (8th May) the unlimited cashback will be capped at £15/mo! As such, I thought I’d share my experiences over the last year, in case others are on the fence.

As a disclaimer, this article is totally unsponsored, and all of this is just my personal experience. Obviously it doesn’t constitute financial advice, do proper research on sites like MoneySavingExpert before making financial decisions, don’t rely on random articles like this!

Background

I opened my Chase current & savings account in early 2022, primarily to use their card abroad without any transaction fees. Since then, their instant access savings rate had steadily risen, so I ended up using it as my main savings. In addition, their daily cashback was reliable and generous, so using Chase for almost all transactions made sense. This cashback was recently changed to be a permanent benefit.

Once I was using Chase for savings AND day to day spending, it didn’t make much sense to have my main current account with a typical high street bank. I went through the hassle of requesting a switch via a paper form (as Chase are not part of the UK current account switch service), and received a message a few days later that it wouldn’t be possible due to my old current account provider not cooperating. Oh well!

As such, I’m slowly manually switching all my direct debits etc, definitely a downside of the account.

May 2023 update: Chase is now part of the current account switch service!

Benefits

As mentioned, I originally started using Chase for the international usage, and the 1-year (now permanent!) promotional perk of 1% cashback. However, they weren’t the only reasons:

Financial

- No monthly account fee.

- The Chase current account has 1% interest, so my day-to-day money will be earning a bit.

- There is unlimited 1% cash-back on spending (up to £15 after 8th May), I believe the most any current account offers.

- Chase has a “Round-up” feature, where transactions get rounded up to the nearest whole £, and the difference put into an account that earns 5% interest(!).

- The Chase savings account has 3.1% interest, and is regularly increasing.

App

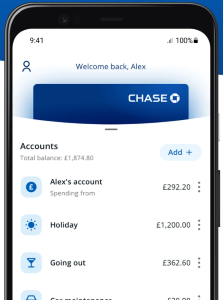

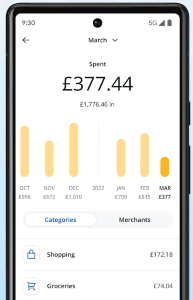

- Compared to the high street bank app I’ve had to use for a few years, the app is extremely sleek and user-friendly.

- The design is very appealing to me personally (more info), being white with blue highlights (my favourite colours!).

- All information is clearly laid out, and the key information (card details, current balance, transaction history) is immediately available and clear.

- When I open the app, once I’ve used my fingerprint there’s no pointless popups / reminders / adverts, just an account overview.

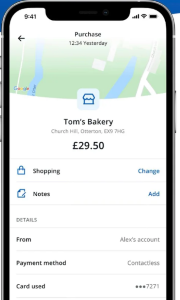

- You can add custom notes to payments, useful for things like Paypal purchases that won’t show details, or ones where the company name is unexpected (e.g. a small market stall might have a generic payment provider name).

- Company logos are added automatically where possible, e.g. Amazon / Sainsbury’s / Deliveroo.

| Overview | Spending | Transaction info |

|---|---|---|

|

|

|

Note: All screenshots are not mine, to avoid accidentally leaking any financial information!

Misc

- The communications are useful, and reasonable. My former bank would regularly send me emails with obvious scam prevention tips, banal advice about shopping online, and similarly pointless topics, despite having all email preferences turned off. Instead, Chase emails me actual useful information, usually about an increase in interest rates!

- The Chase card has no international fees, and worked perfectly when I travelled in Europe & US recently.

- The card itself matches the branding (and my aesthetic taste!) well, being a solid blue colour:

Downsides

Whilst I obviously really like the account, it isn’t perfect. Here are the issues I’ve experienced in the last year or so:

It’s not part of the Current Account Switch Service, and even their manual switch doesn’t seem to work.May 2023 edit: Now part of CASS.- Last year the app had a bug that broke logging in, and I needed to clear the app cache to fix it.

- The card is Mastercard, but debit, causing 1-2 online retailers to not quite understand how it works and fail to charge it.

- There’s no overdraft, which I prefer having just in case.

- As an app-only account, there are no cheque / cash deposits. Not an issue for me personally, but I can see how it could be a deal breaker.

- The account can’t send / receive money internationally, this is the main reason I’m still intending to keep my old bank account open after the switch.

Conclusion

Overall, the account is almost exactly what I want, with by far the biggest drawback being the inability to easily switch to it (now part of CASS). This, plus the inability to make international payments means having an additional current account is still a good idea just in case.

Still, if your current account is earning pretty much nothing in terms of interest / cashback / linked savings, it’s a no-brainer to switch in my opinion. Hopefully Chase’s high financial benefits will prompt less digital banks to improve their offerings.